All the services you need without having to visit the bank.

Check balances, transfer funds, pay bills available 24 hours a day!

Online Banking

Banking available from the comfort and convenience of your home, office or on the road. Online Banking is accessible 24 hours a day, seven days a week, and best of all – this service is FREE!

Online Bill Pay

Bill Pay with Zelle® makes it a breeze to pay your bills online, pay friends and family or request a payment. It’s simply the best way to manage your payments.

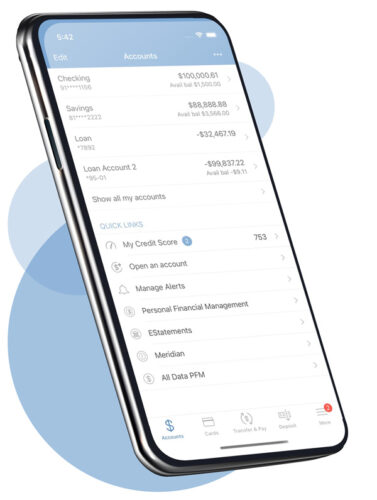

Mobiliti Mobile Banking

Banking available at your fingertips! Mobiliti is an Internet based service that delivers the convenience of Online Banking to your mobile device. Mobiliti allows you to perform banking related transactions from your phone 24/7

Use the Bank of Bridger Mobiliti App to:

Use the Bank of Bridger Mobiliti App to:

- Check balances, pay bills, transfer money, and locate Bank of Bridger branches and ATMs.

- Mobile Check Deposit – Make deposits right from your mobile phone and save yourself a trip to the bank.

- Use Zelle® to pay anyone with a U.S. bank account.

- e-alerts – Receive alerts from Bank of Bridger on your mobile device.

*We never store personal or account information on your mobile device. All transactions are encrypted with the same secure technology as online banking.

Download the App Today!

Mobile Deposit

Make a check deposit when and where you want using the camera in your mobile phone, tablet or ipad! Making a deposit is as easy as taking a picture. All you need is Mobiliti enrollment and a web-enabled device with a camera.

How it Works:

-

- Install our Bank of Bridger APP on any supported device

- Launch the APP and select “New Deposit”

- Select the account to deposit the check into and type in the amount

- Snap a well-lit picture of both sides of your endorsed check

- Confirm your deposit and you’re done

Send and receive money with Zelle®

We have partnered with Zelle® to bring you a fast and easy way to send and receive money with friends, family and people you know. With Zelle®, you can send money directly from your account to enrolled recipients in minutes, all from the convenience of online banking or our mobile app.